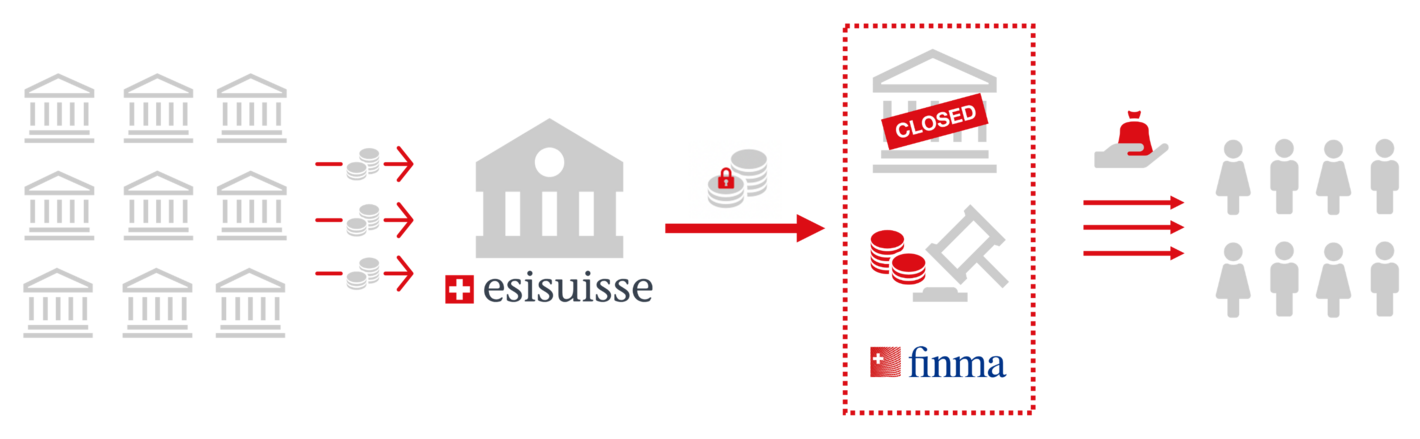

什么是瑞士银行存款保险制度?保额为多少?

瑞士本土持牌银行,例如:杜高斯贝银行、瑞讯银行的存款受存款保险计划保护。

在某家瑞士本土银行破产的情况下,存款保险计划可保护客户存款免受高达 100000瑞士法郎(法律规定)的损失。 如果客户在同一家银行拥有多个账户,则贷方余额相加,最高金额为100000瑞士法郎。

从2023年1月1日起,瑞士银行存款保险制度将发生部分细则变化。如果某家瑞士本土银行破产,存款保险计划可保护客户存款免受高达10万瑞士法郎的损失。以下是自2023年1月1日起适用的最重要的法律变更:

1、针对联名账户的保额有何变化?

如果几个人共同拥有一个瑞士银行帐户(联名账户),则在破产保护方面,该组人士将只被视为一个独立客户。如果该组人士拥有多个银行帐户,则将这些帐户汇总计算;该组人士的账户余额受破产保护,最高保额为10万瑞士法郎。举例来说,这类联名账户可能包括配偶、简单的合伙企业、继承人团体或公寓协会。

如果此类团体中的个人与银行有自己的单独客户关系,则此单独客户关系的余额最多为10万瑞士法郎也会受到破产保护。截止2022年12月31日,联名账户的保险余额将在联名集体中的个人之间分配,然后将分割金额与个人自己的独立客户关系的索赔保护上限(每人10万瑞士法郎)相加。具体举例可参考:https://www.esisuisse.ch/en/deposit-insurance/changes-as-of-2023

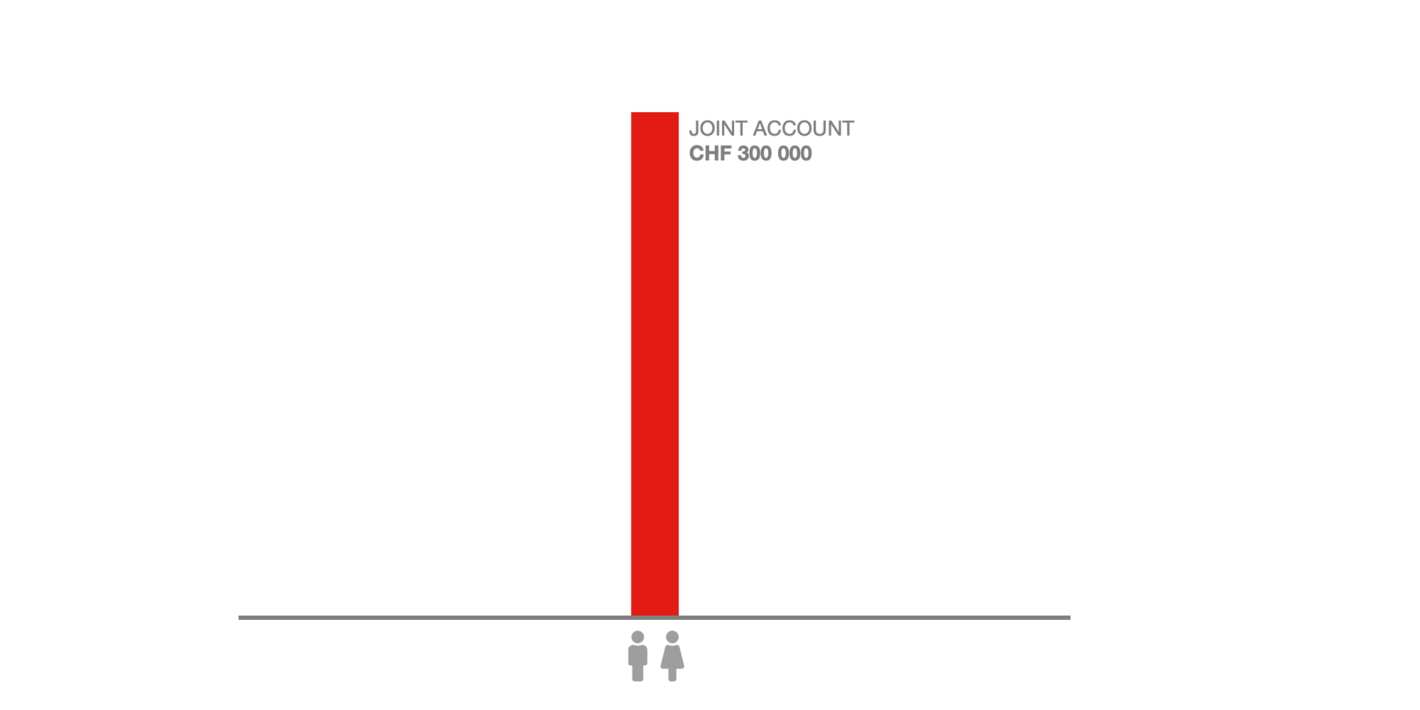

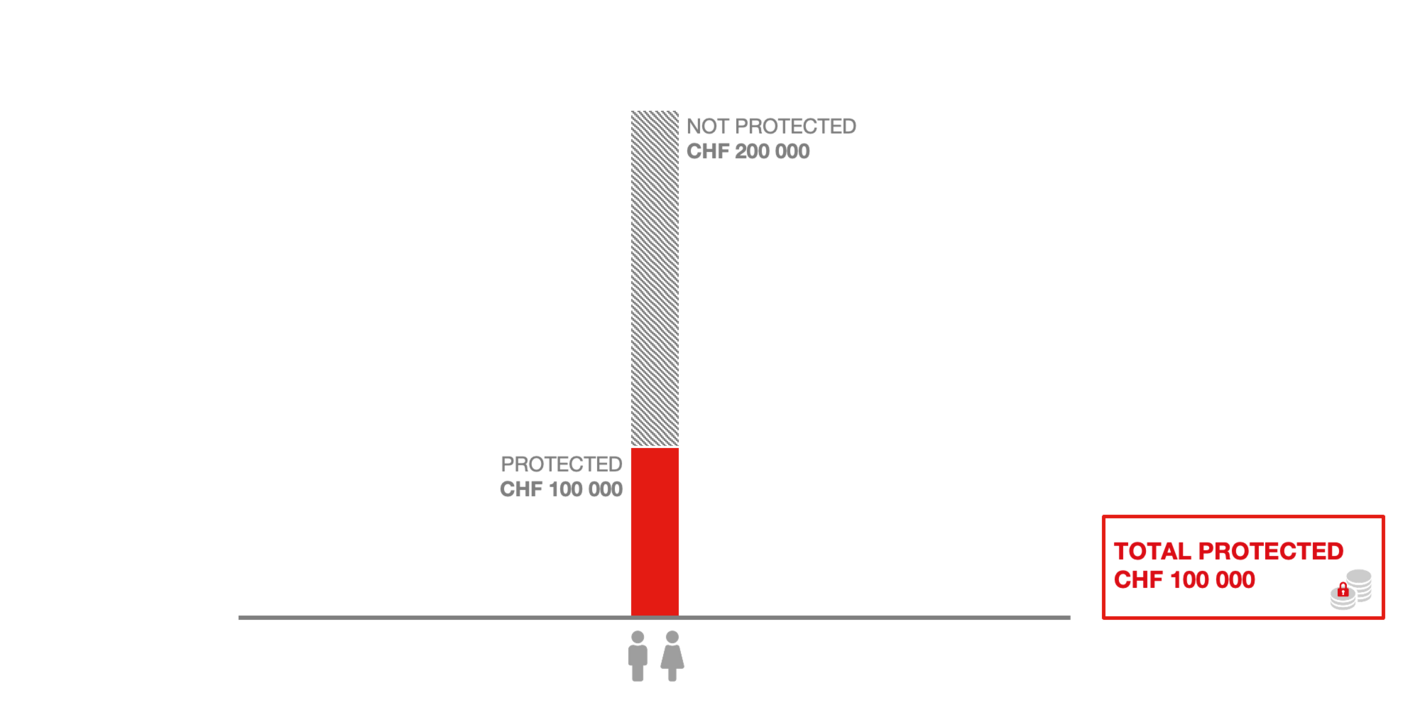

Example 1 – Joint account only

Joint account only

The spouses have a joint account with a balance of CHF 300 000.

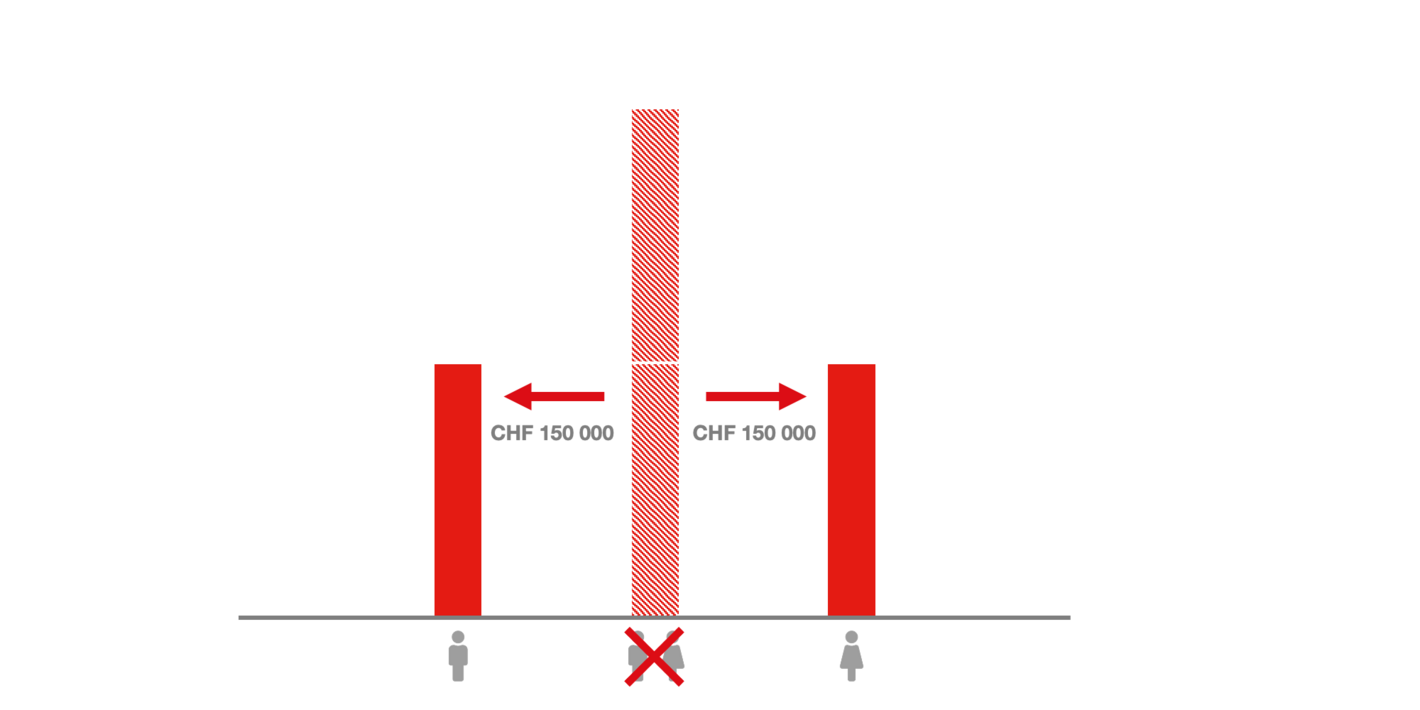

Until 31.12.2022: division of the joint account

In the past, the balance on the joint account was divided equally between the two spouses to determine the amount of the protected deposit.

Until 31.12.2022: guarantee of deposits in the event of a bank’s bankruptcy

These two parts were then each limited to a maximum of CHF 100 000 per person in each case.

The community had no claim of its own. The spouses therefore had a protected deposit of CHF 200 000 in total.

As of 01.01.2023: guarantee of deposits in the event of a bank’s bankruptcy

As of 1 January 2023, the community of spouses now forms its own separate depositor. Their joint account will no longer be divided, but the joint account will be protected with a maximum of CHF 100 000.

In this example, the protected amount is reduced from CHF 200 000 to CHF 100 000.

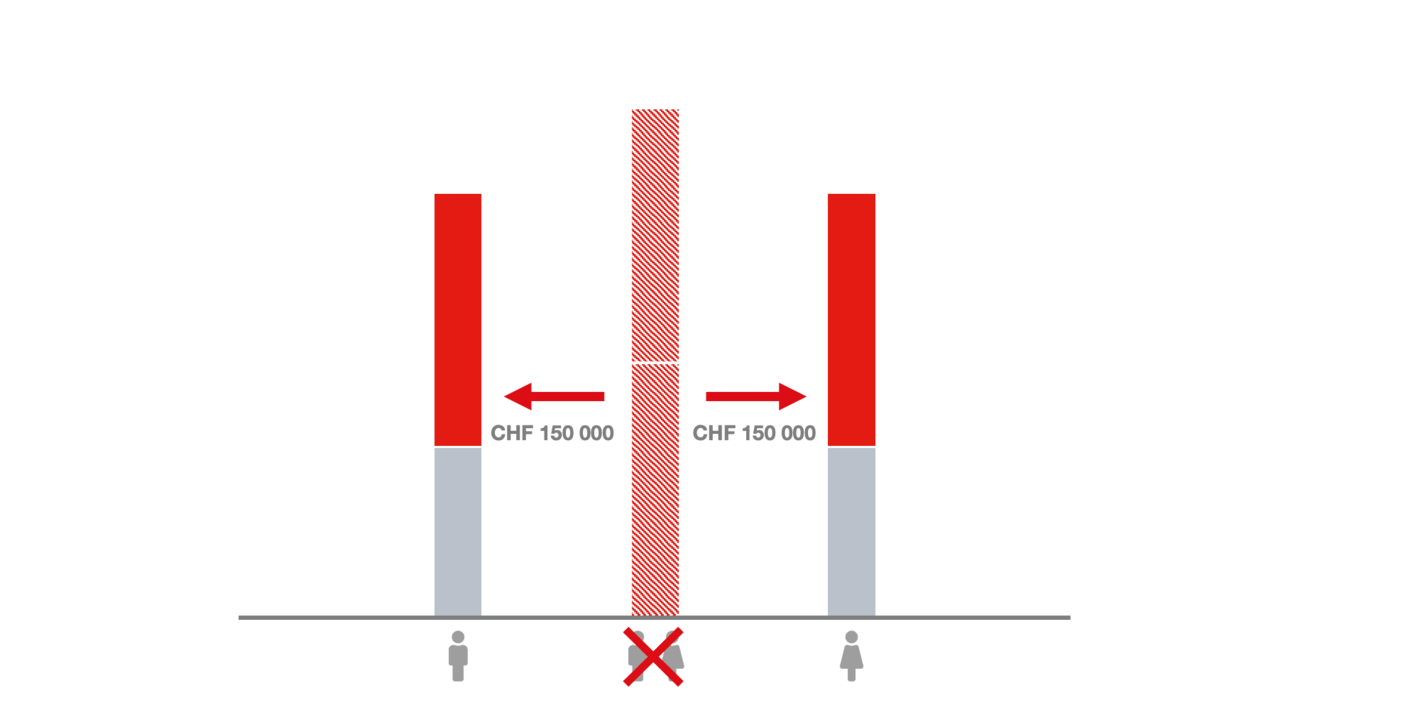

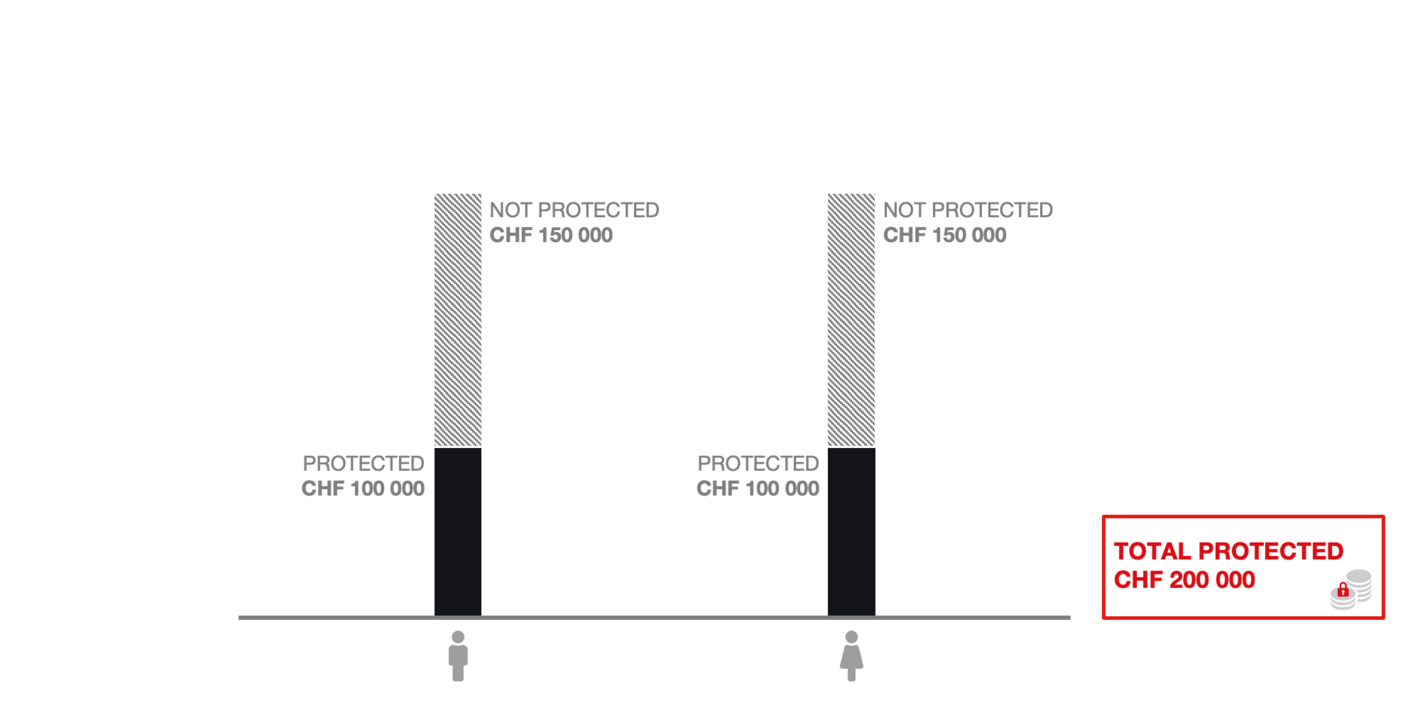

Example 2 – Joint account and two personal accounts

Joint account and two personal accounts

The spouses have a joint account with a balance of CHF 300 000.

The wife has her own account with CHF 100 000 and the husband also has his own account with CHF 100 000.

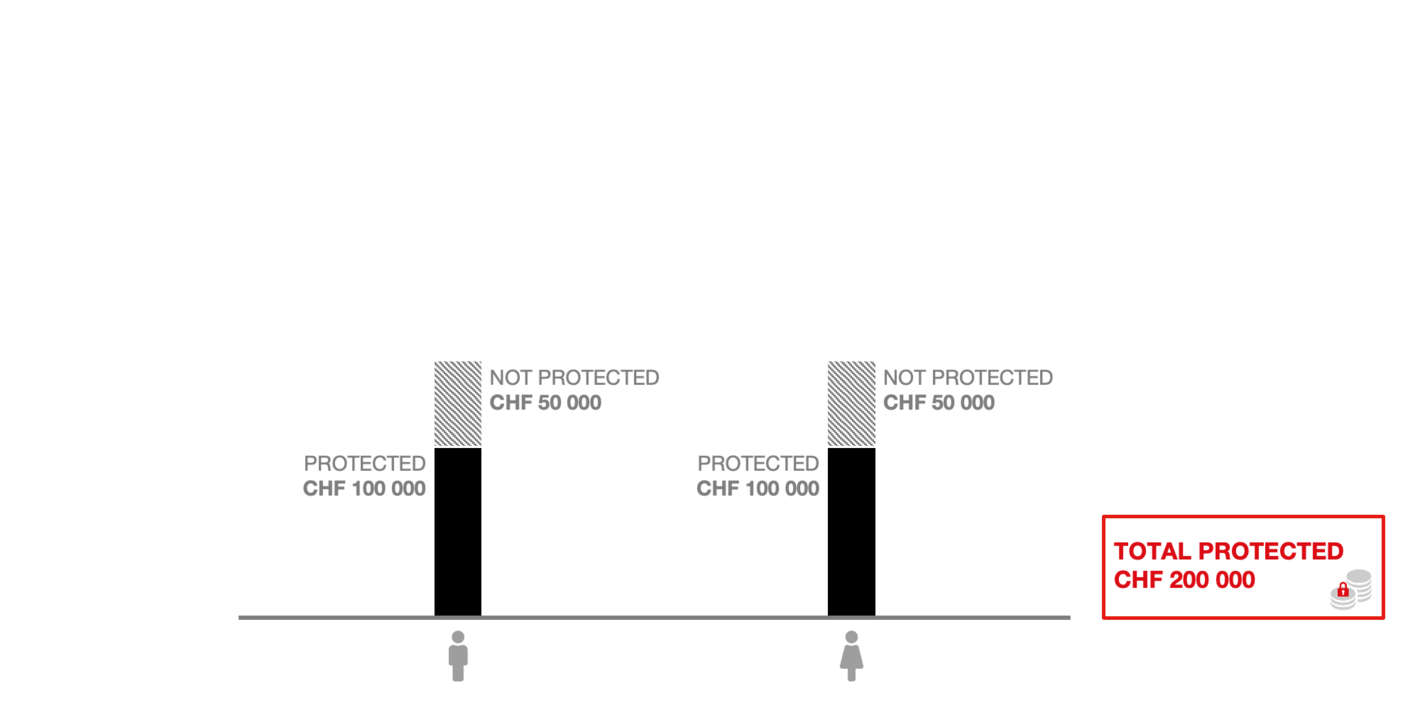

Until 31.12.2022: division of the joint account

In the past, the balance on the joint account was divided equally between the two spouses to determine the amount of the protected deposit. The community had no claim of its own.

In this example, the balance of the joint account was divided between the husband and wife at CHF 150 000 each.

Until 31.12.2022: guarantee of deposits in the event of a bank’s bankruptcy

Afterwards, the divided amount was added to the balance of the own personal account. Finally, this sum was each limited to the protected amount of a maximum of CHF 100 000 per person.

The spouses had protected deposits of CHF 200 000 in total from their personal accounts and the joint account.

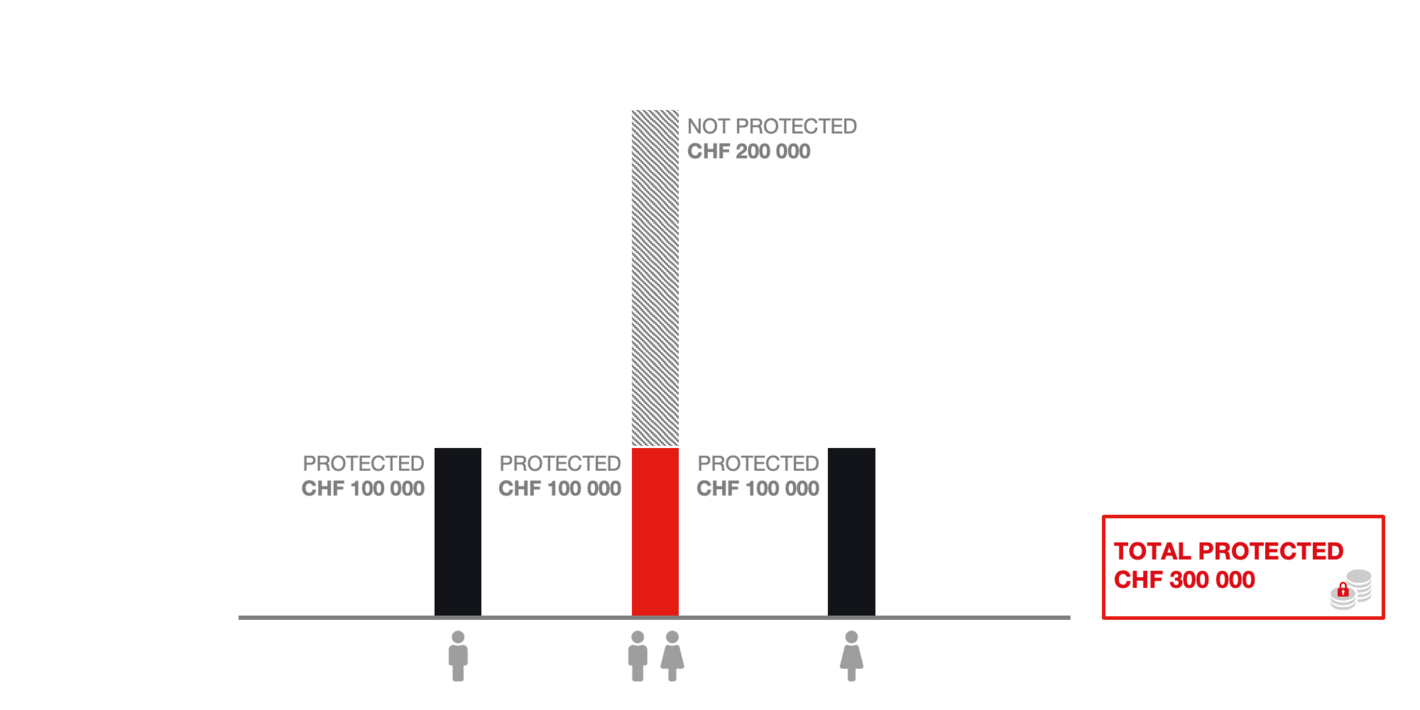

As of 01.01.2023: guarantee of deposits in the event of a bank’s bankruptcy

As of 1 January 2023, the spouses now form a community that has its own claim. The deposits of the community are protected up to CHF 100 000.

In our example, the spouses therefore have protected deposits of CHF 300 000 in total.

2、存款保险的赔付资金有何变化?

瑞士的所有本土银行在法律上都有义务持有相应流动性,以防它们被要求支付存款保险的赔付款项。

自2023年1月1日起,他们必须以证券或现金的形式提前将50%的付款义务存入第三方托管人;其余50%仍需遵守适用于银行的流动性要求。所有银行的支付义务 – 目前为60亿瑞士法郎 – 正在增加。从2023年1月1日起,该金额将增至约80亿瑞士法郎,这一数额相当于瑞士所有受保护存款的1.6%的法律规定的价值。

3、对客户的赔付细则有何变化?

清算人首先使用银行的可用流动性来支付受保护的存款。

如果银行的流动性不足以支付受保护存款,esisuisse必须为支付受保护存款提供资金。

esisuisse有最多 20 天的法定期限,可以在这段时间内将必要的资金转移给清算人。自 01.01.2023 起,截止日期为七个工作日。支付所需的时间长短取决于银行的结构和客户的合作。预计持续数周。截至 01.01.2028:清算人收到客户的支付指令后,目标是在七个工作日内支付。

4、针对金融中介机构有什么变化?

«金融中介机构» 不再受到保护(在破产的情况下没有保护,也没有对存款的特权处理)。 例如,这些包括其他银行、证券公司和保险提供商。

5、外国分支机构的客户有什么变化?

如果客户在银行的外国分行有存款,则他们被视为该分行的个人独立客户。 出于保护目的或破产法规定的特权待遇,在瑞士登记的存款和在外国分行登记的存款不再加在一起。 记在国外分行的存款将继续不受保护,但将根据破产法获得最高 100000 瑞士法郎的特权待遇。

6、法律对银行存款的保护在哪里?

存款保护的法律规定可以在修订后的银行法第 36a 至 37jbis 条和修订后的银行法第 42a 至 44a 条中找到 条例。 尽管我们竭力避免矛盾,但请注意,法律规定具有权威性,而这份不具有法律约束力的客户通知不具权威性。

具体细则:https://www.esisuisse.ch/en/deposit-insurance/changes-as-of-2023

相关问答:https://www.esisuisse.ch/en/deposit-insurance/questions-and-answers-faq